Alec Sharples, Ruthin, WalesIt’s great that the payroll module links so well with HMRC so that all the records they need can be transmitted electronically. Very easy to use and tremendous backup and support if we need it.

SUM-IT’s farm payroll software takes the stress out of farm employment. Carry out wage, tax & pension calculations at the click of a button.

Payroll Built For Farmers

Our Ag payroll software is built with the agricultural industry in mind.

Total Payroll handles both hourly and period paid employees, multiple overtime rates etc. See below for details on our Daily Casuals Module and Piece Worker Software.

Make Paying Staff Quick & Easy

Total Payroll calculates all Tax, National Insurance and Pension deductions and prints/emails full payslips. It generates all figures required for month and year-end returns.

Furthermore it also seamlessly integrates with our Total Farm Accounts Software.

Expert Help Just a Phone Call Away

SUM-IT's farm payroll software is backed up by our friendly support helpline. Our dedicated passionate team is always happy to answer your questions and keep you going to get your payroll sorted.

Key features

- Calculates your farm wages instantly

- Submits RTI Data direct on-line to HMRC

- Handles Auto Enrolment Pensions

- Unlimited number of employees

- No special payslip stationery needed

- Runs multiple ag company payrolls

- Integrates with TOTAL2 Accounts

- Daily Casuals Module

From £295+vat

Fully compatible with:

Key Benefits of our Farm Payroll Software

Be in Control

Have access to individuals’ records, upcoming wage bills and tax in an instant. The farmer-friendly front screen will always alert you to any upcoming actions required and features such as employee calendars and printable timesheets gives you full control.

Save Time

Our farm payroll software is easy to use, allowing you to prepare your wages in only a few minutes. It will automatically calculate tax and pension contributions and you can even export BACS payment files to your bank’s website, making monthly pay runs a breeze.

Grow Profits

Our program automatically calculates any tax and pension contributions and the dashboard will alert you to any upcoming payments, meaning you will never need to worry about inaccurate or missed payments. Email payslips directly and save associated printing costs.

TOTAL Peace of Mind

Submit your Real Time Information direct to HMRC and export workplace pension contribution files, making it easy to keep to all your legal obligations. With on-going updates, you can be rest assured all these links as well as tax and NI tables will be kept current.

Secure Your Free Live Demonstration Today

Book a complimentary, no pressure demonstration with one of our friendly experts. See exactly how Total2 will look on your computer and ask us any questions you may have. Our team member will recommend the best package for your farm, with absolutely no-obligation to buy.

Simply fill out our 30 second online form and someone will be in touch to arrange the best time for the demo.

Book an interactive demonstration

Book TodayTotal Farm Payroll Software

Total Payroll automatically carries out all required calculations, including taxes, leave and pension contributions. The relevant data is then sent direct to HMRC & employees.

Automated Payroll

Easily put in each employees’ pay, weekly, monthly or even daily. Our payroll software will then sort out the rest.

Seamless Links With HMRC

Submit payment and deduction details to HMRC each payday electronically through Total Payroll.

Payslips Sorted

Automatically produce professional payslips which can be printed or emailed to employees.

Reduced Data Input

When run alongside the TOTAL2 Accounts, the Total Payroll Module will update the Accounts with all payment details each pay period.

Workplace Pensions

Fully integrated Auto Enrolment calculations save you time and stress. Easily generate compatible files to upload to Workplace Pension websites for Nest, People’s Pension, Now Pension and Smart Pension.

Ready To Go

You can start using Total Payroll at any time in the PAYE Tax Year.

One-Off Affordable Price

Choose from Small version (up to 3 employees) £295 + VAT or Standard version (Unlimited employees) £495 + VAT.

Total Payroll Video

Daily Casuals Module for Beaters and Harvest Workers

Easily handle the payment and reporting of Daily Casual Workers, such as Harvest Workers and Beaters, under the latest RTI regulations.

Simply record which Casual Workers have been paid on any given day, declaring that they were only taken on for that day only and therefore were not liable for Tax or NI.

You compile a list of which workers could be attending, with their basic employment details, and then each day you simply tick which ones worked on that day and input how much they were paid.

The module, in conjunction with the Total Payroll software, will then submit an FPS electronically to HMRC to cover that day’s activity.

The Daily Casuals Module costs £200 + VAT.

Daily Casuals Pay Input screen

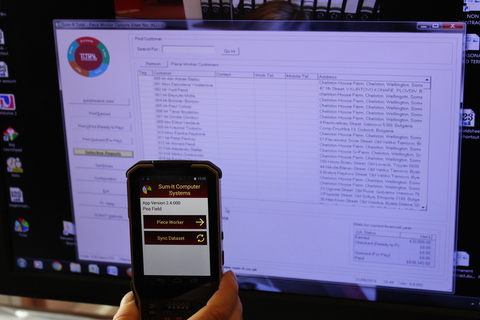

Total Piece Worker Module

SUM-IT's Total Piece Worker is a complete system to streamline and automate the whole process of capturing hand-picked produce records across multiple harvest sites right the way through to generating individual picker payslips.

Outside in the picking location each Picker wears a waterproof wristband containing an NFC chip storing their identity.

As they present their picked produce to the Site Manager, their wristband is scanned by our rugged Mobile Data Logger running the Piece Worker App (offline).

Then the picker’s record appears on-screen and the quantity of produce is recorded along with the location and time/date.

When convenient the Piece Worker App sends the picking data either over 3G from the field or via local WiFi back to Total Piece Worker on the main Farm Office PC or Server.

Reports then help you quickly reconcile what was picked against what’s in the store. Once checked, the data is transferred into the Total Payroll system to calculate each picker’s actual pay after Tax, NI and other deductions then individual payslips are printed off on either plain A4 or self-sealing stationery.

Contact us to discuss your requirements.

Picker wearing NFC Chip

Optional Modules and Equipment

TOTAL2 Accounts Module

Our next generation farm-specific accounts allows you to keep on top of your farm accounts with ease. TOTAL2 accounts integrates seamlessly with the Payroll module.

Payroll Leaflet

Looking to print out all the features of our Total Payroll program? Click here for a printable overview.

Hardware Requirements

Total software operates on Windows 10, 11 and Windows Server. Suitable hardware should have a minimum of 4GB Ram and the software will require 500MB of Hard Disk capacity plus an internet connection to receive program updates and communicate with HMRC and BCMS. Need help with purchasing your farm computer? Our experienced team can help.

Bespoke Software Development

If you have a specific software requirement not covered by our main product range then please contact us and ask about our bespoke software development.

Want to see it in action?

We are currently offering free live no-obligation demonstrations of all our programs.

Book your demo today.

Alternatively, call us on 01844 213003